How to Report FOREX Profits & Losses | Finance - Zacks

How to Report FOREX Losses | Finance - Zacks

Forex Taxation Basics - Investopedia

Five Ways To Deduct Losses In Financial Markets | GreenTraderTax

Foreign currency trading: Mr Taxman

Tax Treatment of Forex Gains/Losses Forex Factory

I do my taxes via Turbo Tax, and until now the complexity of my taxes was no more difficult than entering a salary, and obvious deductions

How to Report FOREX Losses | Finance - Zacks

Traders on the foreign exchange market, or Forex, use IRS Form 8949 and Schedule Finance; Tax Information; Tax Deductions; How to Report FOREX Losses Forex net trading losses can be used to reduce your income tax liability

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and

Tax Treatment of Forex Gains/Losses Forex Factory

I do my taxes via Turbo Tax, and until now the complexity of my taxes was no more difficult than entering a salary, and obvious deductions

How to Report FOREX Losses | Finance - Zacks

Traders on the foreign exchange market, or Forex, use IRS Form 8949 and Schedule Finance; Tax Information; Tax Deductions; How to Report FOREX Losses Forex net trading losses can be used to reduce your income tax liability

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and

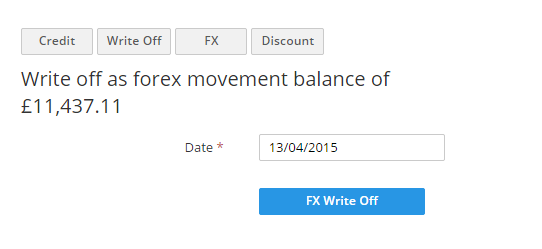

How to account for Forex Trading gains/losses in individual tax return

As a general rule, foreign exchange gains and losses are subject to tax on 'revenue' account, which means that gains are assessable and losses are deductible

Five Ways To Deduct Losses In Financial Markets | GreenTraderTax

Aot 2015 -

How to Report FOREX Profits & Losses | Finance - Zacks

Reporting FOREX profits and losses depends on if it is an over-the-counter trade will allow investors to claim some capital gains deductions on profit or losses

How to Report FOREX Losses | Finance - Zacks

Traders on the foreign exchange market, or Forex, use IRS Form 8949 and Schedule Finance; Tax Information; Tax Deductions; How to Report FOREX Losses Forex net trading losses can be used to reduce your income tax liability

How to account for Forex Trading gains/losses in individual tax return

As a general rule, foreign exchange gains and losses are subject to tax on 'revenue' account, which means that gains are assessable and losses are deductible

Five Ways To Deduct Losses In Financial Markets | GreenTraderTax

Aot 2015 -

How to Report FOREX Profits & Losses | Finance - Zacks

Reporting FOREX profits and losses depends on if it is an over-the-counter trade will allow investors to claim some capital gains deductions on profit or losses

How to Report FOREX Losses | Finance - Zacks

Traders on the foreign exchange market, or Forex, use IRS Form 8949 and Schedule Finance; Tax Information; Tax Deductions; How to Report FOREX Losses Forex net trading losses can be used to reduce your income tax liability

How to Report FOREX Losses | Finance - Zacks

Traders on the foreign exchange market, or Forex, use IRS Form 8949 and Schedule Finance; Tax Information; Tax Deductions; How to Report FOREX Losses Forex net trading losses can be used to reduce your income tax liability

Forex Taxation Basics - Investopedia

For beginner forex traders, the goal is simply to make successful trades In a market where Of these trades, up to 60% can be counted as long-term capital gains/losses Tax Rate Most traders will anticipate net gains (why else trade?) so they will want to elect out of their 988 status and in to 1256 status To opt out of a

How to account for Forex Trading gains/losses in individual tax return

As a general rule, foreign exchange gains and losses are subject to tax on 'revenue' account, which means that gains are assessable and losses are deductible

Forex gains and losses? - TurboTax Support

Spot FOREX Trade Taxes By default, retail FOREX traders fall under Section 988, which covers short-term foreign exchange contracts like s

How to Report FOREX Losses | Finance - Zacks

Traders on the foreign exchange market, or Forex, use IRS Form 8949 and Schedule Finance; Tax Information; Tax Deductions; How to Report FOREX Losses Forex net trading losses can be used to reduce your income tax liability

Forex Taxation Basics - Investopedia

For beginner forex traders, the goal is simply to make successful trades In a market where Of these trades, up to 60% can be counted as long-term capital gains/losses Tax Rate Most traders will anticipate net gains (why else trade?) so they will want to elect out of their 988 status and in to 1256 status To opt out of a

How to account for Forex Trading gains/losses in individual tax return

As a general rule, foreign exchange gains and losses are subject to tax on 'revenue' account, which means that gains are assessable and losses are deductible

Forex gains and losses? - TurboTax Support

Spot FOREX Trade Taxes By default, retail FOREX traders fall under Section 988, which covers short-term foreign exchange contracts like s

Hey day traders: Here are some tax strategies for you - MarketWatch

Il y a 3jours -

Forex Taxation Basics - Investopedia

For beginner forex traders, the goal is simply to make successful trades In a market where Of these trades, up to 60% can be counted as long-term capital gains/losses Tax Rate Most traders will anticipate net gains (why else trade?) so they will want to elect out of their 988 status and in to 1256 status To opt out of a

How to account for Forex Trading gains/losses in individual tax return

As a general rule, foreign exchange gains and losses are subject to tax on 'revenue' account, which means that gains are assessable and losses are deductible

Hey day traders: Here are some tax strategies for you - MarketWatch

Il y a 3jours -

Forex Taxation Basics - Investopedia

For beginner forex traders, the goal is simply to make successful trades In a market where Of these trades, up to 60% can be counted as long-term capital gains/losses Tax Rate Most traders will anticipate net gains (why else trade?) so they will want to elect out of their 988 status and in to 1256 status To opt out of a

How to account for Forex Trading gains/losses in individual tax return

As a general rule, foreign exchange gains and losses are subject to tax on 'revenue' account, which means that gains are assessable and losses are deductible

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and

Forex Taxation Basics - Investopedia

For beginner forex traders, the goal is simply to make successful trades In a market where Of these trades, up to 60% can be counted as long-term capital gains/losses Tax Rate Most traders will anticipate net gains (why else trade?) so they will want to elect out of their 988 status and in to 1256 status To opt out of a

Forex gains and losses? - TurboTax Support

Spot FOREX Trade Taxes By default, retail FOREX traders fall under Section 988, which covers short-term foreign exchange contracts like s

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and

Forex Taxation Basics - Investopedia

For beginner forex traders, the goal is simply to make successful trades In a market where Of these trades, up to 60% can be counted as long-term capital gains/losses Tax Rate Most traders will anticipate net gains (why else trade?) so they will want to elect out of their 988 status and in to 1256 status To opt out of a

Forex gains and losses? - TurboTax Support

Spot FOREX Trade Taxes By default, retail FOREX traders fall under Section 988, which covers short-term foreign exchange contracts like s

Tax Treatment of Forex Gains/Losses Forex Factory

I do my taxes via Turbo Tax, and until now the complexity of my taxes was no more difficult than entering a salary, and obvious deductions

Foreign currency trading: Mr Taxman

Dc 2011 -

How to Report FOREX Profits & Losses | Finance - Zacks

Reporting FOREX profits and losses depends on if it is an over-the-counter trade will allow investors to claim some capital gains deductions on profit or losses

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and

Tax Treatment of Forex Gains/Losses Forex Factory

I do my taxes via Turbo Tax, and until now the complexity of my taxes was no more difficult than entering a salary, and obvious deductions

Foreign currency trading: Mr Taxman

Dc 2011 -

How to Report FOREX Profits & Losses | Finance - Zacks

Reporting FOREX profits and losses depends on if it is an over-the-counter trade will allow investors to claim some capital gains deductions on profit or losses

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and

Forex Taxation Basics - Investopedia

For beginner forex traders, the goal is simply to make successful trades In a market where Of these trades, up to 60% can be counted as long-term capital gains/losses Tax Rate Most traders will anticipate net gains (why else trade?) so they will want to elect out of their 988 status and in to 1256 status To opt out of a

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and

Five Ways To Deduct Losses In Financial Markets | GreenTraderTax

Aot 2015 -

Hey day traders: Here are some tax strategies for you - MarketWatch

Il y a 3jours -

How to account for Forex Trading gains/losses in individual tax return

As a general rule, foreign exchange gains and losses are subject to tax on 'revenue' account, which means that gains are assessable and losses are deductible

How to Report FOREX Losses | Finance - Zacks

Traders on the foreign exchange market, or Forex, use IRS Form 8949 and Schedule Finance; Tax Information; Tax Deductions; How to Report FOREX Losses Forex net trading losses can be used to reduce your income tax liability

Forex Taxation Basics - Investopedia

For beginner forex traders, the goal is simply to make successful trades In a market where Of these trades, up to 60% can be counted as long-term capital gains/losses Tax Rate Most traders will anticipate net gains (why else trade?) so they will want to elect out of their 988 status and in to 1256 status To opt out of a

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and

Five Ways To Deduct Losses In Financial Markets | GreenTraderTax

Aot 2015 -

Hey day traders: Here are some tax strategies for you - MarketWatch

Il y a 3jours -

How to account for Forex Trading gains/losses in individual tax return

As a general rule, foreign exchange gains and losses are subject to tax on 'revenue' account, which means that gains are assessable and losses are deductible

How to Report FOREX Losses | Finance - Zacks

Traders on the foreign exchange market, or Forex, use IRS Form 8949 and Schedule Finance; Tax Information; Tax Deductions; How to Report FOREX Losses Forex net trading losses can be used to reduce your income tax liability

Tax Treatment of Forex Gains/Losses Forex Factory

I do my taxes via Turbo Tax, and until now the complexity of my taxes was no more difficult than entering a salary, and obvious deductions

Forex gains and losses? - TurboTax Support

Spot FOREX Trade Taxes By default, retail FOREX traders fall under Section 988, which covers short-term foreign exchange contracts like s

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and

Tax Treatment of Forex Gains/Losses Forex Factory

I do my taxes via Turbo Tax, and until now the complexity of my taxes was no more difficult than entering a salary, and obvious deductions

Forex gains and losses? - TurboTax Support

Spot FOREX Trade Taxes By default, retail FOREX traders fall under Section 988, which covers short-term foreign exchange contracts like s

Capital Losses and Tax | Investopedia

Capital losses are never fun to incur, but they can reduce your taxable income Knowing the rules for capital losses can help you maximize your deductions and